Hurray for today is the last day of 2013. Remember my financial and personal goals update post? Well today i will be ending my Finanancial and Personal Goals before 2013 ends post because i am looking forward to a more detailed list that i will be putting on a separate page in this blog. So this will be my last update for you guys. Fortunately i was able to complete almost everything on my list! Yehey!!1

- Convert my current BDO ATM Debit Card to a Passbook one so it can earn interest. This means i have to

maintain 5,000pesos savings.I have 5,435pesos in my savings account BUT i wasn't able to upgrade it to passbook because the teller said i will have to reapply again. I don't have time so i will convert it early next year. - Achieve a mutual fund investment. This is quiet not attainable now. I reserve this goal next year.

Grow my instagram shop @theashoppe.I released a beauty box!!! Yahoo!!! if you still have no idea i will post in a separate blog. But yeah, i was able to release a beauty box for my shop.

- Have my SSS number and

Philhealthcard. Will continue the process this Saturday. I already have my Philhealth PIN. YES!!! Got last Saturday my SSS number and i also had my Philihealth ID. :) - A post a day in this blog site. Another thing i wasn't able to accomplish.

- Attend one financial seminar. Too busy to do so.

- Buy a new Ipad case. Still wasn't able YES!!! It is a clear Ipad case which is super perfect!!! :)

Help one church missionary. I am helping one missionary from Victory Laguna for just 500pesos a month.Be consistent in my tithes.Yes!!!- Have my laptop's lcd fixed. Still wasn't able to. I have the money now but the repair shop is closed so i will be able to do this by first week of next year.

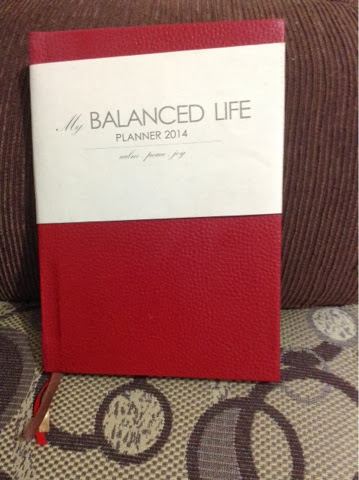

- Invest more financial related book. I will before the month ends. YES!!! Bought one which i will do a review very very soon.

- One Travel or out-of-town trip. Probably not. Reserve for next year.

- Start my emergency fund. Probably not. Reserve for next year.

So that's it for my goals. I am very proud that i have achieved so much though i only have too little time. Thank you for being with me and thank you too because even if i am just starting you have put my blog on top 150 financial blogs of 2013 from Topblogs.ph. THANK YOU!!!