For the first week of February I have received questions from Sir Jonathan all concerning investing in FAMI-SALEF. I asked him if I could share his question as part of this month's Reader Question together with the answer I personally sent him. Glad that he agreed as both us know that there may be others who have the same question in mind but don't know how or whom to ask.

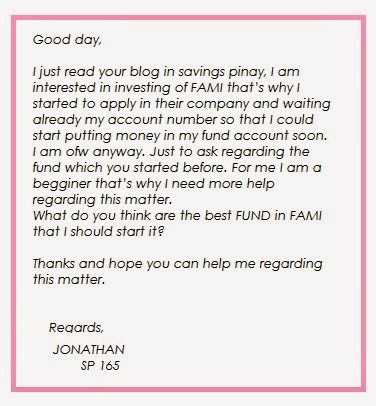

Anyhow here's the full message of Sir Jonathan.

This the answer that I gave:

-------------------------------------

Good Afternoon Sir Jonathan!

Thank you for the inquiry and congratulations for taking a firm stand towards financial freedom.

I've known FAMI because of reading financial blogs. I've searched and found out zero to none negative feedbacks on the company. Most of the personal finance bloggers that I know invest in a Mutual Fund first before they start diversifying into other investment vehicles.

Choosing FAMI-SALEF as my very first investment is sort of an impulse move for me. That time almost all are complementing the result of FAMI-SALEF over time. Again I want to stress on the following factors that I considered why I chose First Metro Asset Management Inc.

- I already have the Metrobank payroll and FAMI is part of Metrobank so it will be very convenient for me use the online banking in topping up my investments.

- I am a newbie so a Mutual Fund is just a nice start up account for me.

The product I chose was the Save and Learn Equity. I have a post up on my blog about Managed Funds and here's a quick Infographic Sir.

Here's the link for the blog posts: Understanding managed Funds as an Investment Vehicle in the Philippines

An Equity Fund has the highest risk factor but the return is as high too!

Here's the September 2014 Fund Sheet of FAMI-SALEF:

- FAMI-SALEF has the highest ROI of all FAMI products.

- FAMI-SALEF is an equity and a very good investment vehicle for those who are into long term investing.

- FAMI-SALEF puts your money in a variety of resources. From Fixed Income, Properties, Holding COmpanies to Transport, Power and Telcoms.

If you really want to learn more about investing Sir, I suggest visiting this post of mine. I included almost all of good resources when it comes to investing:

Again thank you so much for this inquiry! I hope I have helped you in a way or two.

If you have further concerns don't hesitate to send an email! :)

Goodluck!

_____________________________________________________________________________________

There will be Part 2 and Part 3 of Sir Jonathan's inquiry since he sent 2 more questions. I actually tried to answer the two questions via email but sadly, I received a MAILER-DAEMON saying my email wasn't successfully sent. So Sir Jonathan if you are reading this please stay tune for the coming Reader Question as I will answer na po yung inquiries.

Thanks!

MORE READER'S QUESTIONS FROM THE PAST:

- READER'S QUESTION: How does FAMI work???

- READER'S QUESTION: Should a 21 year old save up money or spend it on things that make him happy?

- READER'S QUESTION: What do you do na di mo nagagamit yong nasave mo ?

- READER's QUESTION: "Which is better Savings Account, Mutual Fund or UITF?"

- Reader Qustion: I'm 18 years old and want to learn how to invest my money

Be better in your finances. Save Now, Invest Now and walk your way to success. Sign up in my Email List and receive templates to get you started in your Financial Wealth. Follow me on Facebook and Twitter for better updates. Godbless

Post Comment

Post a Comment